The Debt Ceiling Deal

Congress may yet screw it up, but Speaker McCarthy and President Biden have a deal. It's not a terrible deal, but it is an appropriate end to a dysfunctional process.

Over this past weekend, President Biden and Speaker McCarthy announced a deal on legislation to reduce the deficit and suspend the debt ceiling through January 2025. I’m going to have more on this that I’ll release in a professional setting so I won’t provide too much of an overview here, instead, this will be more of a rant. Bluntly, this legislation reflects just how dysfunctional Washington can be and in no way does anything useful from a policy perspective.

As a PR exercise, this legislation nominally is focused on a few big things - primarily avoiding a default on US sovereign debt and reducing our overall budget deficit. There are other measures involved around permitting reform and work requirements, but those largely are superfluous to these two bigger issues. However, if you step even a little bit back from the furious reporting going on in Washington, it rapidly becomes clear that these two items are, respectively, avoiding a self-inflicted wound and such a light touch on deficit reduction as to be meaningless. So when I say that this is dysfunctional legislating, I mean that there is no actual public policy issue resolved through this bill.

First, we’ll dispose of the debt ceiling. The United States is the only nation in the world dumb enough to maintain a debt ceiling that is financially relevant (Denmark has one but it is set so high it’s functionally meaningless). While there has been much talk about a debt crisis here in the United States, there are markets that exist around sovereign debt and while US costs have crept up recently, there is no evidence that there is any pending sovereign debt crisis. Borrowing costs are rising due to higher interest rates to combat inflation, but remain below the levels of the 1980s and 1990s. If House Republicans hadn’t decided to take the debt ceiling hostage, there would be no actual debt crisis. So this legislation solved an entirely self-imposed problem created by Congress, rather than anything that actually exists external to our dysfunctional government. Instead, Congress and the White House, particularly House Republicans, have managed to shake confidence in our government and our financial system. This might be worth it if the result of all of this had been an actual deal to stabilize our long-term finances, but, as we’ll go into next, this legislation flatly does not do that.

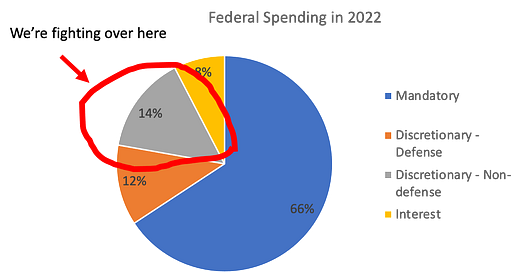

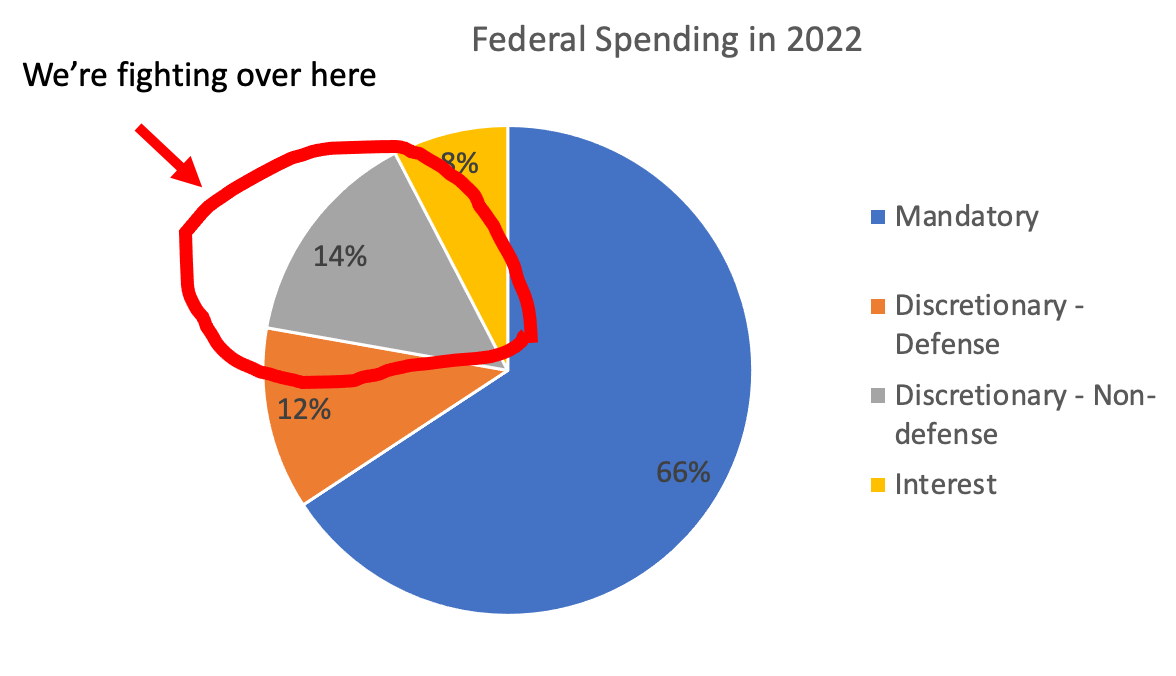

While a full CBO score for the bill text has not been reduced, the numbers I’ve seen have indicated that roughly $1 trillion will be shaved off of the debt over the next ten years (potentially $2.1 trillion if the mostly optional six-year caps are enforced). This is approximately 2% of the roughly $52 trillion we will add to the national debt over the next decade. Basically, if you are actually serious about the national debt (and per the above, it’s not entirely clear that dramatic changes are needed), then you need to be willing to grapple with entitlement spending and tax increases. By refusing to deal with either of those things, House Republicans ensured that fighting was over an already small part of the budget.

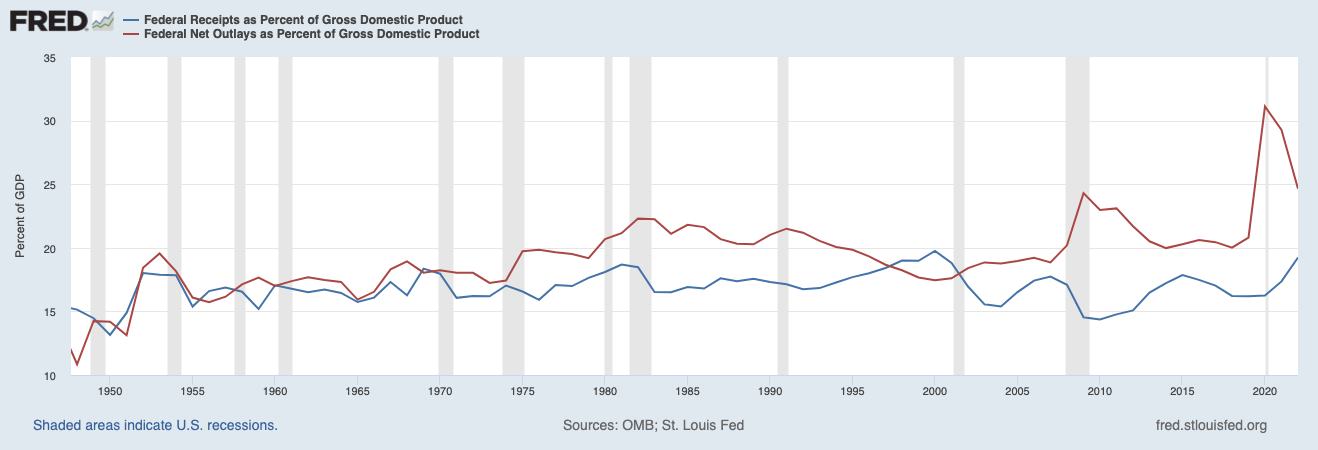

The other issue to look at is revenue. Broadly, we have made a political decision to accept a higher level of government spending (primarily in Social Security, Medicare, and Medicaid) as the Baby Boomer generation retires. Neither party seems interested in reducing their benefits. However, we have manifestly refused to adopt revenues commensurate with what the retirement of the baby boomers means. The chart below shows federal spending and federal revenues as a percentage of GDP through 2021. I’ll just note that the 2020-2021 spike is largely a post-Covid phenomenon and that the revenue percentage in 2022 crashed to 17.1%.

Simply put, if we are going to provide what seems to be politically acceptable benefits then we need to fund them. This too, was off the table for these negotiations. As a result, not only will federal spending continue to grow (primarily driven by mandatory spending), but we will add another $50 trillion to the debt over the next decade. So despite causing an international crisis (for no reason), this bill also fails to meaningfully reduce the debt.

There’s more I could go into, but fundamentally this legislation - which is being treated like some type of bipartisan accomplishment, should instead be viewed as a measure of how dysfunctional our government can be. We avoided an entirely self-inflicted crisis that damaged our credibility and confidence in our financial system in order to accomplish nothing. When people wonder why the population is so negative about Washington, they should look at bills like this and it’s clear that our government deserves much of the scorn heaped upon it.